Bad money drives out good

… states the Gresham’s law, an economic principle. The idea is that if you debased commodity money by adding impurity to the coins, the original “good” (or pure) coins will gradually disappear from circulation. Good money is one where the face value of the coin corresponds to the value of the commodity. Bad money, conversely, is where the face value of the coin is higher than value of the commodity. (read more here)

This economic principle is just as true today. If metal was the cost of money then, it is interest rates today. Over the last 10 years, since the Zero Interest rate monetary policy and subsequent quantitative easing, the central banks have created cheap money. The cheap “bad” money (thanks to low interest rates and QE) that has funded startups since the Global Financial Crisis (GFC) is pushing out “good” money (pre GFC businesses, where investors demand a decent return on their investment).

If precious metal was the cost of money in the olden days, it is interest rates today.

The cheap money startups can focus on growth and ignore profitability, making life very difficult for businesses funded by good money that need to earn a decent profit. This makes an already handicapping incumbent’s dilemma more extreme. They now need to disrupt their existing business for one with no profit (not just lower profit)!

Furthermore, the cheap “bad” money rewarded such behaviour but assigning increasingly higher value on such businesses. Additionally, the Softbank’s $100B Vision Fund added to inflation of private company valuations. Infact, the valuation of these more expensive set of businesses correlates well with QE, its tapering and then the rise of Vision Fund.

Progeny of the Bad Money Era

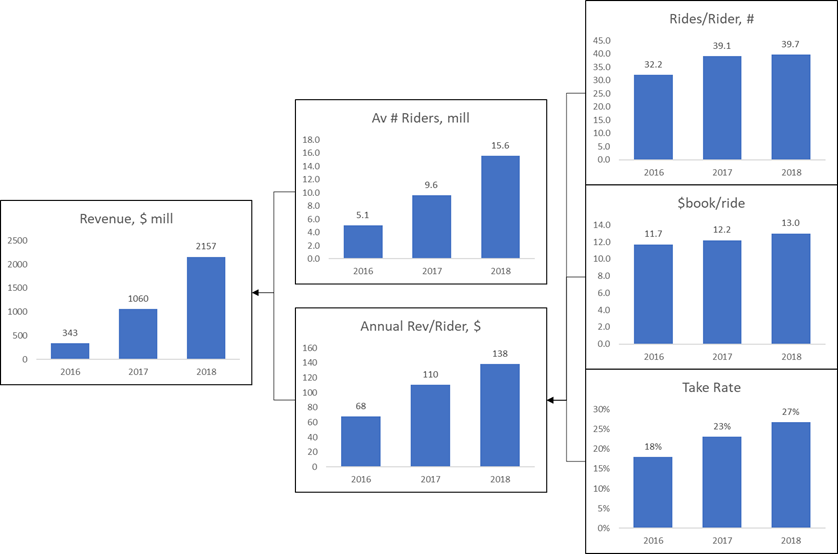

We see the above dynamic in both ride sharing and food delivery. Both of these industries are poster children of the free money era. Both of them have grown thanks to economic models that would have been close to impossible in a world without QE. And then there is Peloton, where the CEO says, “Choosing to not be profitable to focus on growth”. That luxury would not have been afforded 10 years ago.

I have discussed in the past the issue of saturating usage in ridesharing which means in order to continue to grow these businesses need to continue to burn cash.

Food delivery is even worse. Its at best a breakeven business on its own (i.e. without the ordering platform fee), with little to no operating leverage. With an average order value of £25, that adds up to £5.50 per order in revenues (£3 fee charged to restaurant, £2.50 charged to consumer). With a minimum wage £8/hour, training and other HR costs, onboarding costs (driverS churn in 6-12 months), the total cost of a driver is possibly around £12/hour or so. If thats the case, the driver needs to make more than 2x deliveries per hour to cover their own cost. Making a delivery in less than 30 mins is difficult given most ride a cycle, need to wait at the restaurant and walk to the consumers apartment. You can see how this can be difficult to scale.

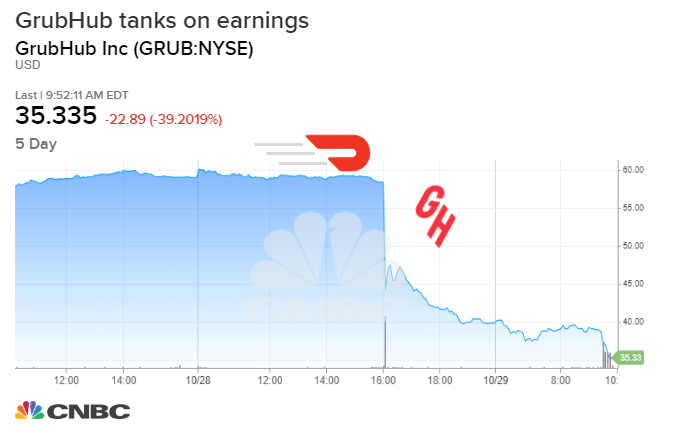

DoorDash drives out GrubHub

Now that’s the real trigger that got me writing this post. And the point here is a bad money funded startup (DoorDash) driving out good money funded incumbent (GrubHub). Last week, GRUB fell over 40% in one day. While that statistic is mind boggling, what’s even more mind numbing is that the volume traded over that day and the next was 82% of all shares outstanding. In other words, almost everyone who owned the stock sold it to someone else. Bad money literally drove out good money.

What did GRUB say?

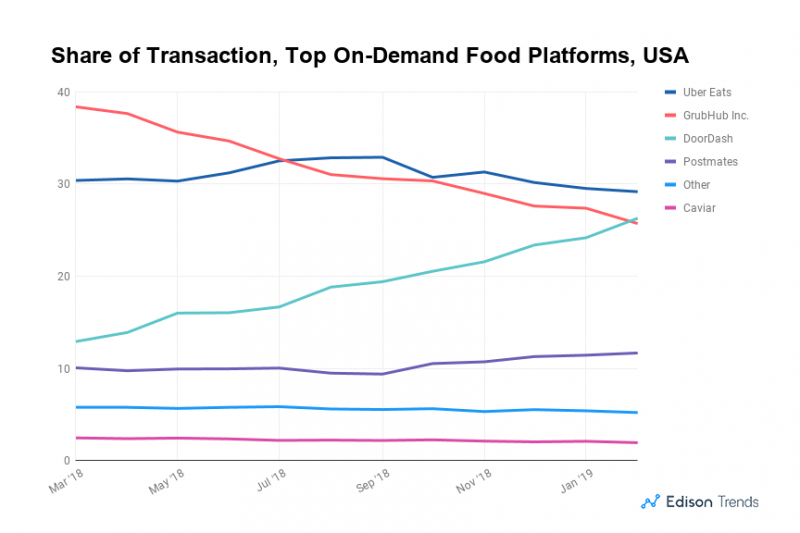

- Consumers have grown more “promiscuous”. There is little loyalty and they order on multiple apps. This is more true for new customers where re-order frequency is lower than in the past

- GRUB needs to invest in delivery to match the offer of startups.

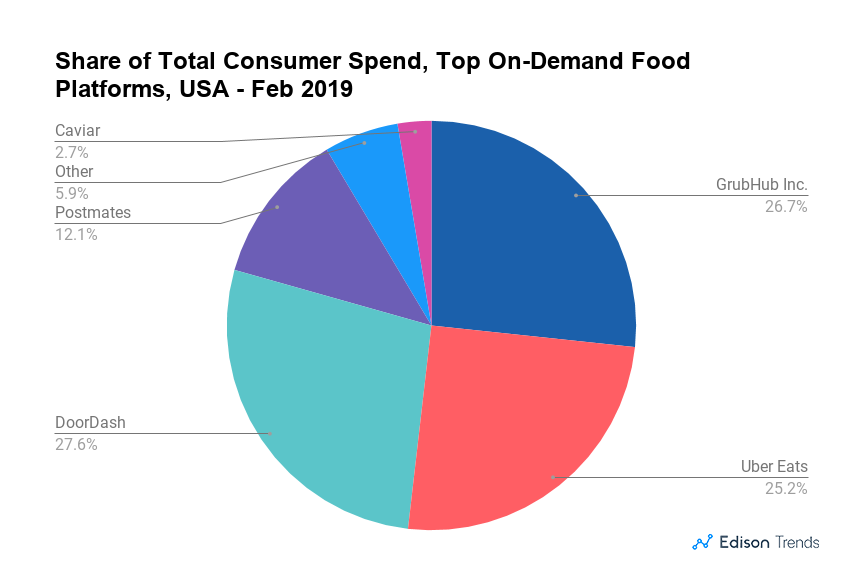

- More competition with startups (DoorDash and Postmates) means going forward growth will be zero sum

In the U.K., something similar happened. Just Eat was driven out by Deliveroo, a business running at 0% gross margin at least as of 2018. Takeaway, another food platform business from Netherlands, offered to merge with Just Eat (and then Prosus bid on Just Eat with a cash offer).

With its recently raised pile of cash, DoorDash has enough ammunition to keep causing pain to Grubhub. Grubhub’s future is likely going to follow that of Just Eat. At first, Just Eat had to start offering delivery services in the UK to neutralise the threat of Deliveroo. And eventually, it agreed to getting acquired by Takeaway.com.

DoorDash Passes Grub in Delivery Market Share

What do you think?

The point is that the last 10 years of free flowing money hasn’t only distorted financial markets (negative bond yields), it has distorted the real world and it has likely distorted how customers behave and how much they expect for free.

I am curious to see how the world works after the next crisis. What do you think?

Disclaimer: None of the above is investment advice. All views are personal and intended to make an analogy or a point, rather than be scientific about details.